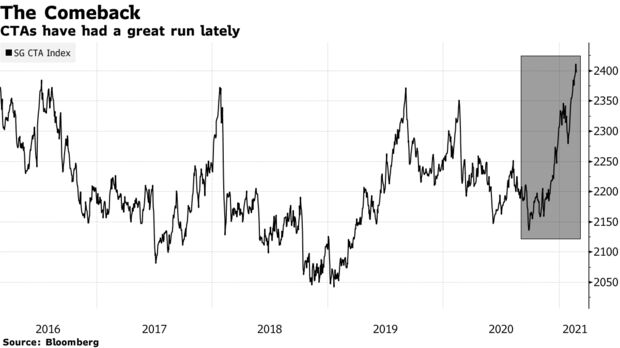

DBi Managing Member, Andrew Beer, explains how managed futures hedge funds stand to benefit from a regime shift in inflation.

With rising expectations on an economic growth fueling trends in everything from Treasuries and oil to stocks, Commodity Trading Advisors just notched one of their best months since 2000,